In the ever-evolving landscape of ride-sharing and delivery services, Uber Technologies Inc. has again found itself grappling with the complexities of market expectations versus actual performance. Recently, the company unveiled its fourth-quarter results, showcasing both impressive revenue growth and disconcerting guidance, leading to a notable 7% decline in its shares during premarket trading. This article delves into the financial dynamics at play, consumer response, and future prospects for the industry giant.

Uber’s fourth-quarter financial results illustrated a compelling narrative: a robust earnings per share of $3.21, significantly exceeding market predictions of merely 50 cents. This impressive amount was buoyed by a staggering revenue of $11.96 billion, surpassing the anticipated $11.77 billion. Year-over-year growth was evident as revenue surged by 20% from $9.9 billion, and the company reported a net income of $6.9 billion, a considerable leap from $1.4 billion the previous year.

However, despite these encouraging numbers, Uber’s guidance for the upcoming quarter raised eyebrows. Projections for gross bookings were set between $42 billion and $43.5 billion, slightly under the analyst estimate of $43.51 billion. Moreover, expected adjusted EBITDA of $1.79 billion to $1.89 billion fell short of the previously anticipated $1.85 billion. This discrepancy prompted investors to reconsider their optimism, reflecting in the stock market reaction.

Diving deeper into the contributing factors behind Uber’s fourth quarter, it is essential to note a significant part of the net income came from a $6.4 billion tax valuation release. The company also enjoyed pre-tax gains of $556 million through equity investment revaluations. While these components undeniably inflate net income figures, they also suggest that the core operational performance may not have been as robust without these timely financial benefits.

The gross bookings figure of $44.2 billion was another highlight, surpassing the $43.49 billion analysts projected. This indicates solid underlying demand for Uber’s services, particularly in its mobility and delivery segments, both of which reported a gross booking of $22.8 billion and $20.1 billion, respectively, each up 18% year-over-year.

One of Uber’s most promising developments includes the public launch of robotaxi rides in Austin, Texas, through a collaboration with Alphabet’s Waymo. Beginning with an interest list for users, this move presents a significant shift toward future-oriented technology and diversification of service offerings. As public acceptance of autonomous vehicles grows, such initiatives could play a vital role in Uber’s long-term strategy.

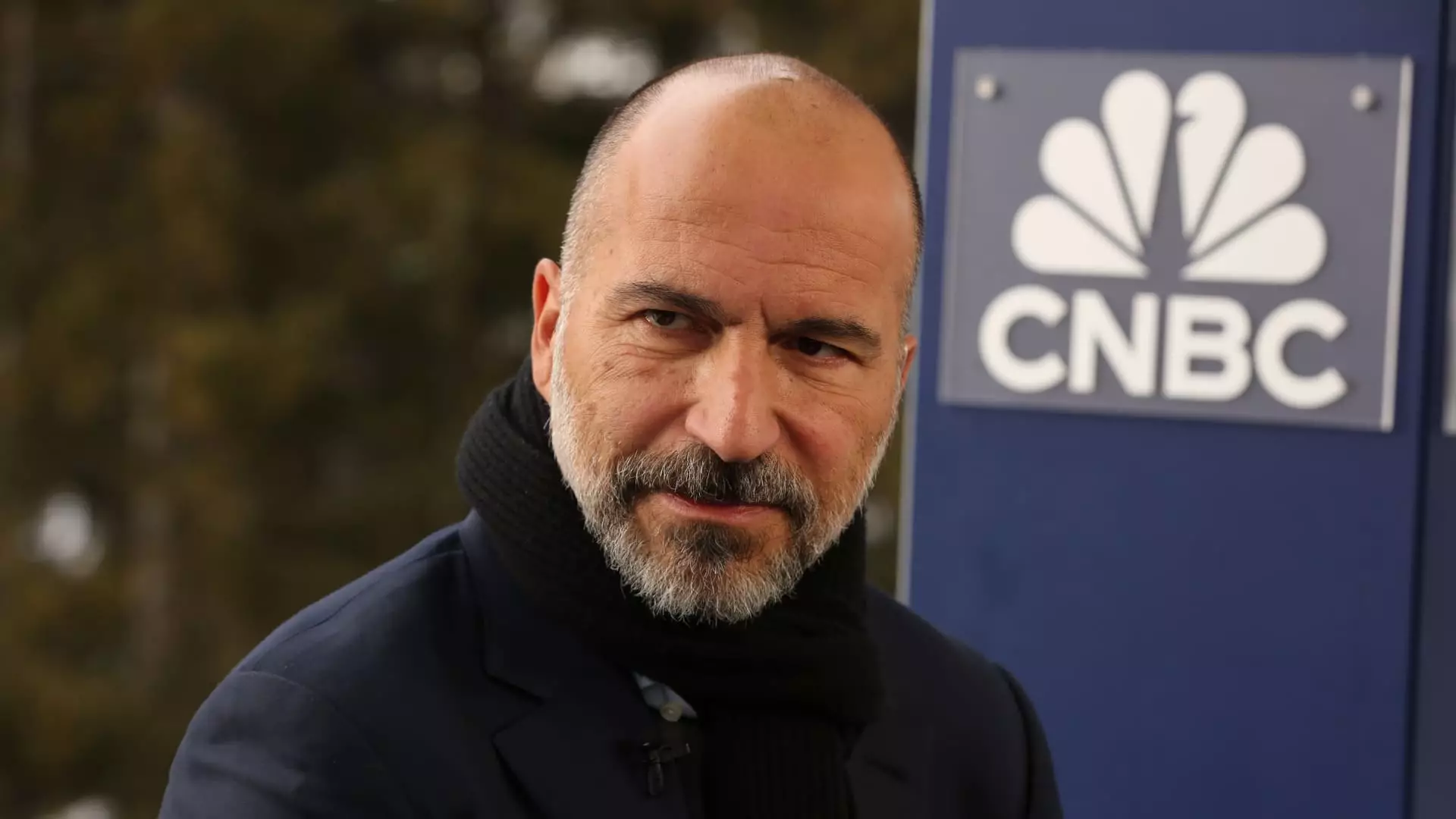

Additionally, the surge in completed trips, totaling 3.1 billion during the last quarter and an increase in monthly active users to 171 million, underscores sustained consumer engagement. However, challenges remain, particularly as consumer spending behavior shifts post-pandemic. Uber’s CEO Dara Khosrowshahi has pointed out that competition is stiff, and consumer focus is increasingly tilting towards services over goods, complicating its freight business dynamics.

In the context of its fourth-quarter results, Uber stands at a crossroads. The company demonstrated its capability to drive significant revenue and increase active users, yet investor sentiment remains cautious amid soft guidance. The integrated launch of innovative solutions like robotaxi rides may provide a window of opportunity to capture market share and redefine urban mobility in the coming years.

However, the company must navigate the unpredictability of consumer preferences and market conditions. As Khosrowshahi articulated, Uber remains committed to relentless execution towards its long-term goals, but aligning short-term financial health with innovative growth strategies will be crucial for its trajectory in an increasingly competitive sector.

In this complex tapestry of financial results, consumer responses, and technological advancements, Uber’s ability to adapt and innovate while maintaining investor confidence will ultimately dictate its future success. The dynamic interplay between impressive growth figures and tempered expectations clearly indicates that while the company has achieved much, significant challenges still lie ahead.