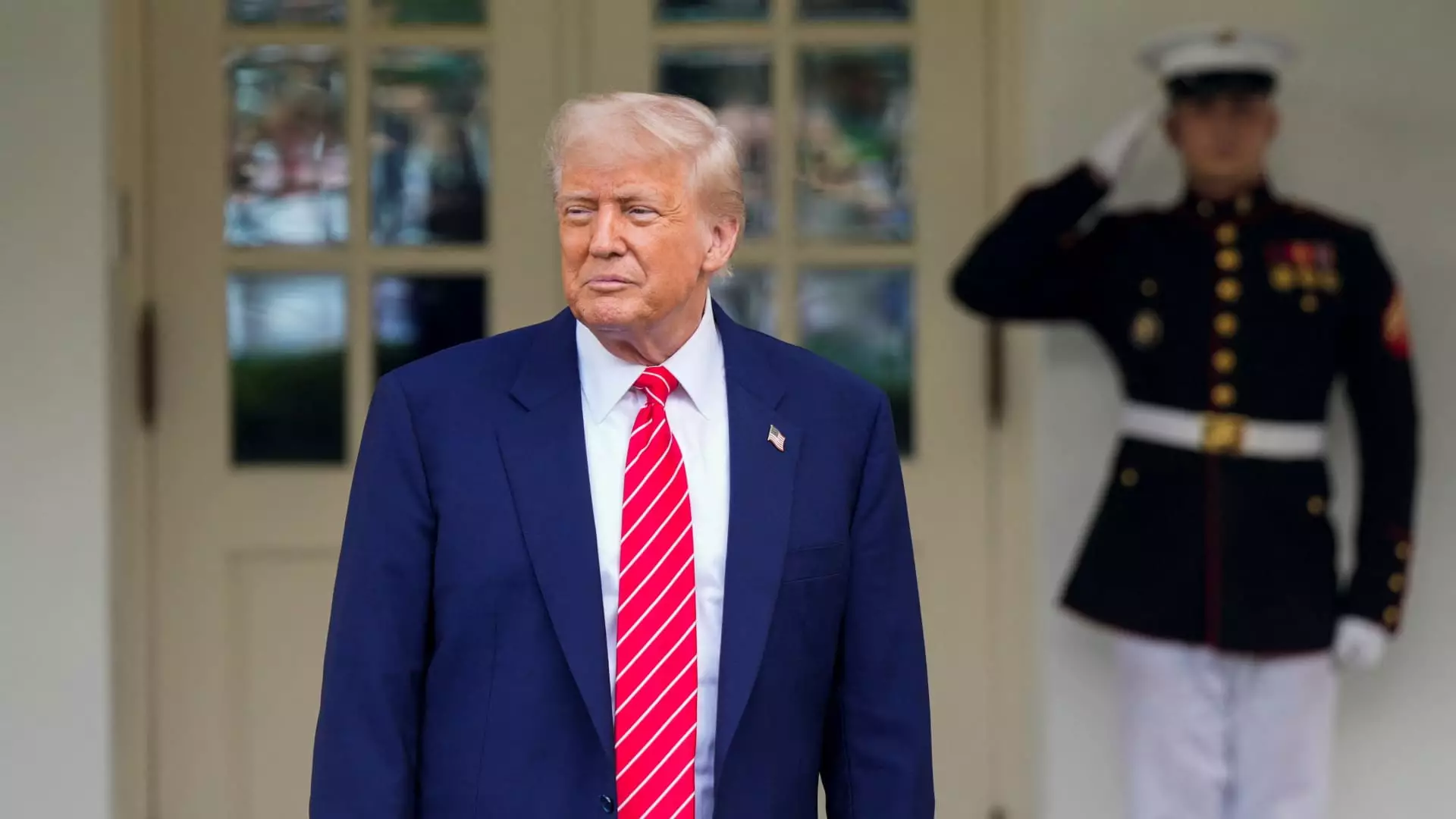

In an era where the lines between public service and private enterprise blur remarkably, the crypto realm in the United States is facing an unprecedented impasse largely due to President Donald Trump’s personal financial involvements. The controversy surrounding the GENIUS Act—a proposed piece of legislation designed to provide a federal framework for stablecoins—illustrates this troubling intersection well. With lawmakers struggling to navigate the waters of cryptocurrency regulation, Trump’s dual roles as president and businessman raise questions that go beyond mere policy; they delve into the very integrity of American democracy.

Recent developments reveal that resistance to the GENIUS Act partly stems from concerns that Trump’s personal crypto ventures create an “unprecedented conflict of interest.” Senator Jeff Merkley’s critical remarks encapsulate the palpable frustration among lawmakers: “This is a profoundly corrupt scheme. It endangers our national security and erodes public trust in government.” When a president can personally benefit from the very assets that legislation aims to regulate, the moral stakes escalate, casting a shadow over the credibility of both Congress and the presidency.

Amidst Political Turmoil, Progress Seems Elusive

The statistical landscape of Congress further complicates matters. The slim Republican majority in the House of Representatives, paired with a filibuster-proof requirement in the Senate, makes passing any legislation a Herculean task—one that seemed somewhat reachable until Trump’s personal interests overshadowed collective legislative goals. The GENIUS Act had seemingly garnered the support of a rare bipartisan coalition; however, it crumbled when nine Senate Democrats, some of whom had supported the bill in committee, opted out in light of Trump’s financial entanglements.

The fallout illustrates a broader unease in Washington: Can a political figure genuinely negotiate for national interests when personal financial stakes are at play? Moreover, it raises questions about the future of bipartisan cooperation, as one party’s leadership casts shadows on what should ideally be a collective focus on the regulatory framework essential for the burgeoning crypto economy.

The Fine Line Between Innovation and Speculation

Stablecoins, digital currencies pegged to the value of traditional assets such as the U.S. dollar, have the potential to revolutionize financial systems. However, the haphazard state of legislative oversight leaves the industry teetering on an unsettling edge. The GENIUS Act was a step toward regulation that many viewed as crucial for safeguarding consumer interests and financial integrity. Yet it’s telling that amidst the debate, significant political undertones, including Trump’s personal crypto initiatives—like the $TRUMP coin—shift legislative discussions from economic growth to ethical dilemmas.

Senator Richard Blumenthal’s description of the dinner incentive for top $TRUMP holders, branded a “pay-for-play scheme,” further underscores this sentiment. The high-profile nature of Trump’s ventures has shifted the conversation from substantive policy-making to ethical scrutiny—a transition detrimental not only to legislation but also to public perception about the integrity of leadership in financial innovations.

External Pressure and Internal Consequences

The legislative stalemate isn’t exclusively a result of internal political strife; external pressures also influence the discourse. Over the past few years, the crypto lobby has gained momentum, becoming a formidable entity that significantly financed Trump’s 2024 campaign. This complicates the narrative; influential lobbyists, eager for favorable policies, find themselves in a complex dance—balancing personal ambitions, political allegiance, and public interest.

Ryan Gilbert, a voice of the fintech sector, articulately expressed the dilemma: “It’s unfortunate that personal business is getting in the way of good policy.” His statement resonates within the industry, where innovators and entrepreneurs yearn for clarity in regulation. The existing environment stymies growth, creating barriers that stifle creativity and obstruct investment opportunities. The widespread dissatisfaction underscores the urgent need for reform that not only rationalizes the crypto landscape but also disentangles it from political conflicts.

A Call for Accountability and More Rigorous Standards

As investigations into Trump’s financial ties intensify, calls for stricter regulations grow louder. The proposed “End Crypto Corruption Act” aims to insulate elected officials from leveraging their positions for personal gain. Yet the very problem it seeks to address embodies a larger challenge within the regulatory framework: How can regulators evolve amid a rapidly changing landscape? If responsibility is to be enforced, it must be a collective endeavor, disentangled from individual profit motives.

In a world pivoting toward digital currencies, the implications of unresolved conflicts of interest could reflect poorly internationally, impacting the United States’ reputation in the fast-evolving crypto industry. As Gilbert grimly forecasted, the prospect of being “the laughing stocks” of the world looms large unless ethical boundaries and regulatory clarity emerge from the current quagmire.

The ongoing struggle for coherent crypto legislation under the shadow of Trump’s ventures not only reflects a critical moment for American politics but also poses fundamental questions about the future of financial innovation. The road ahead requires a commitment to governance that separates personal ambition from public duty, a necessity if the integrity of the financial system—and public trust—is to be safeguarded.