In the competitive world of retail technology, few sectors have evoked as much excitement in recent years as cashierless checkout systems. Among the innovators in this space was Grabango, a startup that emerged from the vibrant tech environment of Silicon Valley in 2016. Founded by Will Glaser, a notable figure with a history in tech entrepreneurship, Grabango aimed to challenge giants like Amazon with its sophisticated checkout-free technology. Unfortunately, despite its initial promise and significant backing, the company succumbed to financial hurdles and has officially ceased operations. This narrative highlights both the allure and the peril inherent in the startup ecosystem, particularly within a rapidly evolving market.

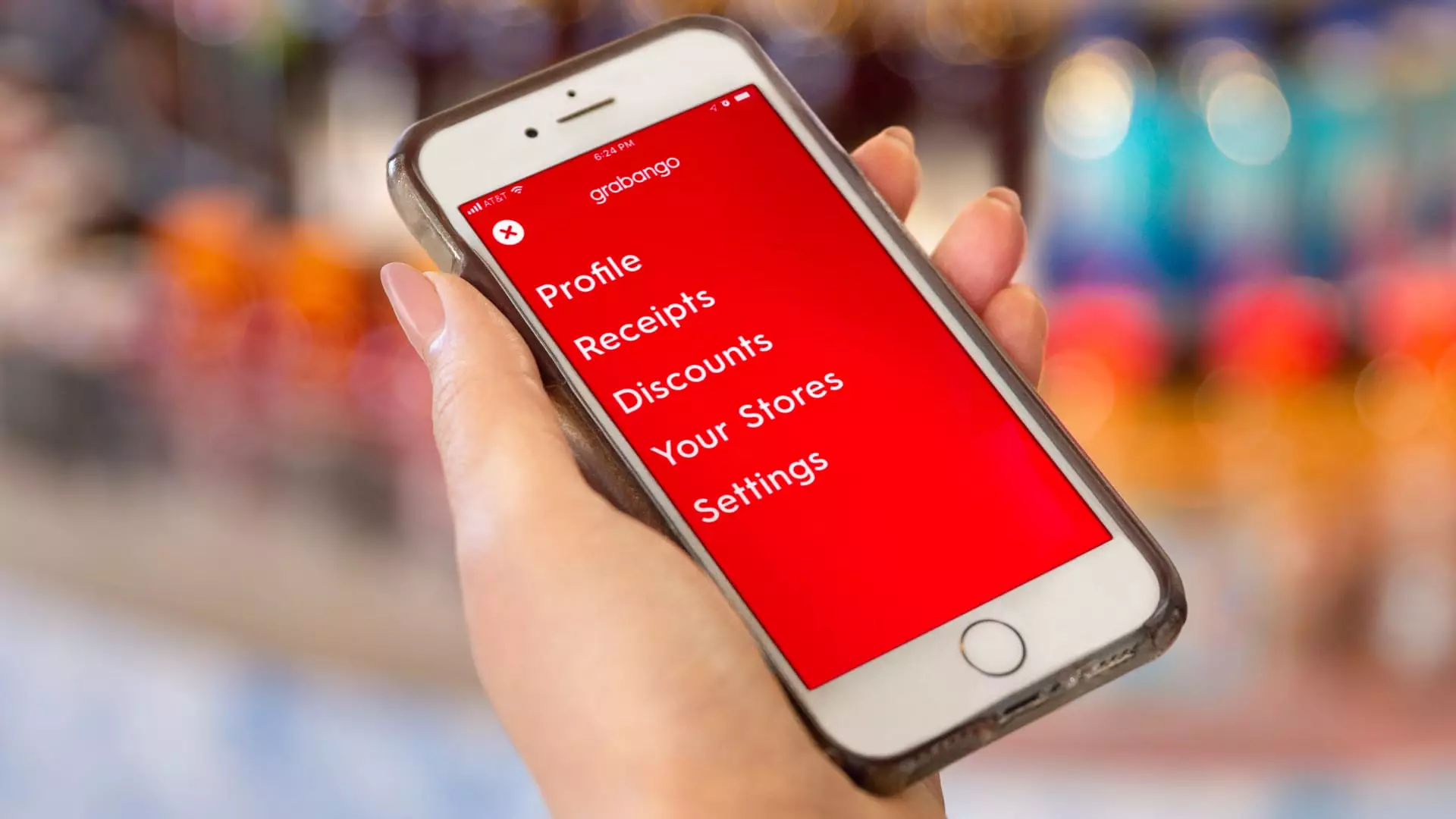

At the core of Grabango’s offerings was its advanced checkout-free technology, which leveraged cutting-edge computer vision and machine learning to streamline the customer shopping experience. This system enabled shoppers to simply select items off the shelves, allowing for seamless payments without traditional checkout processes. Such innovation promised to redefine how consumers interacted with retail spaces, reminiscent of the transformative impacts of e-commerce. Grabango’s investment in technology was not merely superficial; it signified a profound understanding of consumer needs in an age increasingly dominated by digital solutions.

The credibility of Grabango was further bolstered by its association with prominent retail partners, such as Aldi and 7-Eleven. These collaborations positioned Grabango as a key competitor against alternative solutions from major players, including Amazon’s Just Walk Out technology. However, despite these promising alliances, Grabango struggled to make lasting inroads in a landscape overshadowed by heavyweights with deeper financial resources.

The Challenge of Financing and Scaling

Despite raising over $73 million since its launch, including a notable $39 million round led by Commerce Ventures in 2021, Grabango faced an insurmountable challenge as the market dynamics shifted. Venture funding that once flowed relatively freely began to dry up, with the general venture landscape becoming increasingly cautious in the face of economic uncertainties. The transition from a surging investment climate to a stark financial reality caught many startups off guard.

In parallel, the IPO market also faced significant contraction, particularly following a trend of dwindling public offerings since early 2022. This constrained environment placed additional pressure on Grabango to secure further investment against a backdrop of reduced investor confidence. Such a scenario poses existential risks for many startups; without adequate capital, even the most inventive ideas can falter.

Grabango’s situation also sheds light on the broader implications for the tech industry, particularly concerning startups vying for dominance in established markets. While Grabango initially appeared as a formidable contender against Amazon’s Just Walk Out service, the reality proved more complex. The retail space was already littered with notable competitors, including AiFi and Trigo, each vying for the same contracts and recognition.

The competitive pressures contributed to an unsustainable business model for Grabango, which despite its technological prowess, could not secure enough market share or funding to ensure viability. The nature of innovation is such that it often requires sustained investment to achieve scale, and in a competitive environment, failing to capture consumer loyalty swiftly could lead to obsolescence.

The closure of Grabango stands as a poignant reminder of the relentless challenges faced by startups in cutting-edge sectors. It highlights the critical need for not only technological innovation but also robust financial backing and strategic partnerships. The narrative serves as an important lesson for aspiring entrepreneurs: that navigating the volatile waters of the tech industry requires more than just a groundbreaking idea—it demands resilience, foresight, and the ability to pivot when circumstances demand adaptation.

As the retail sector continues to evolve, lessons from Grabango’s rise and fall will undoubtedly inform future endeavors in the cashierless technology space. Understanding the delicate interplay between technology, finance, and consumer behavior will be essential as new players emerge and existing giants recalibrate their strategies in a dynamic market.