As the global landscape pivots towards sustainable practices, Australia is strategically positioning itself as a potential leader in clean energy technology, particularly through its new National Hydrogen Strategy. Released by Federal Climate Change and Energy Minister Chris Bowen, this comprehensive blueprint aims to steer the nation towards producing green hydrogen, effectively eliminating the reliance on high-emission fuels. Having evolved from the initial National Hydrogen Strategy established in 2019, this updated document reflects not only a growing urgency for climate action but also a nuanced understanding of the complexities involved in hydrogen production and its integration into existing industries.

Hydrogen, the simplest and most abundant element in the universe, is emerging as a cornerstone for achieving net-zero emissions. Specifically, green hydrogen is produced using renewable energy to separate hydrogen from water, a remarkably clean process when compared to conventional methods that involve fossil fuels. This shift could revolutionize sectors like steel and chemical manufacturing, which have typically relied on carbon-intensive processes. The strategic vision laid out in the recent announcement is invaluable for outlining how hydrogen might transform both the Australian economy and the global energy landscape.

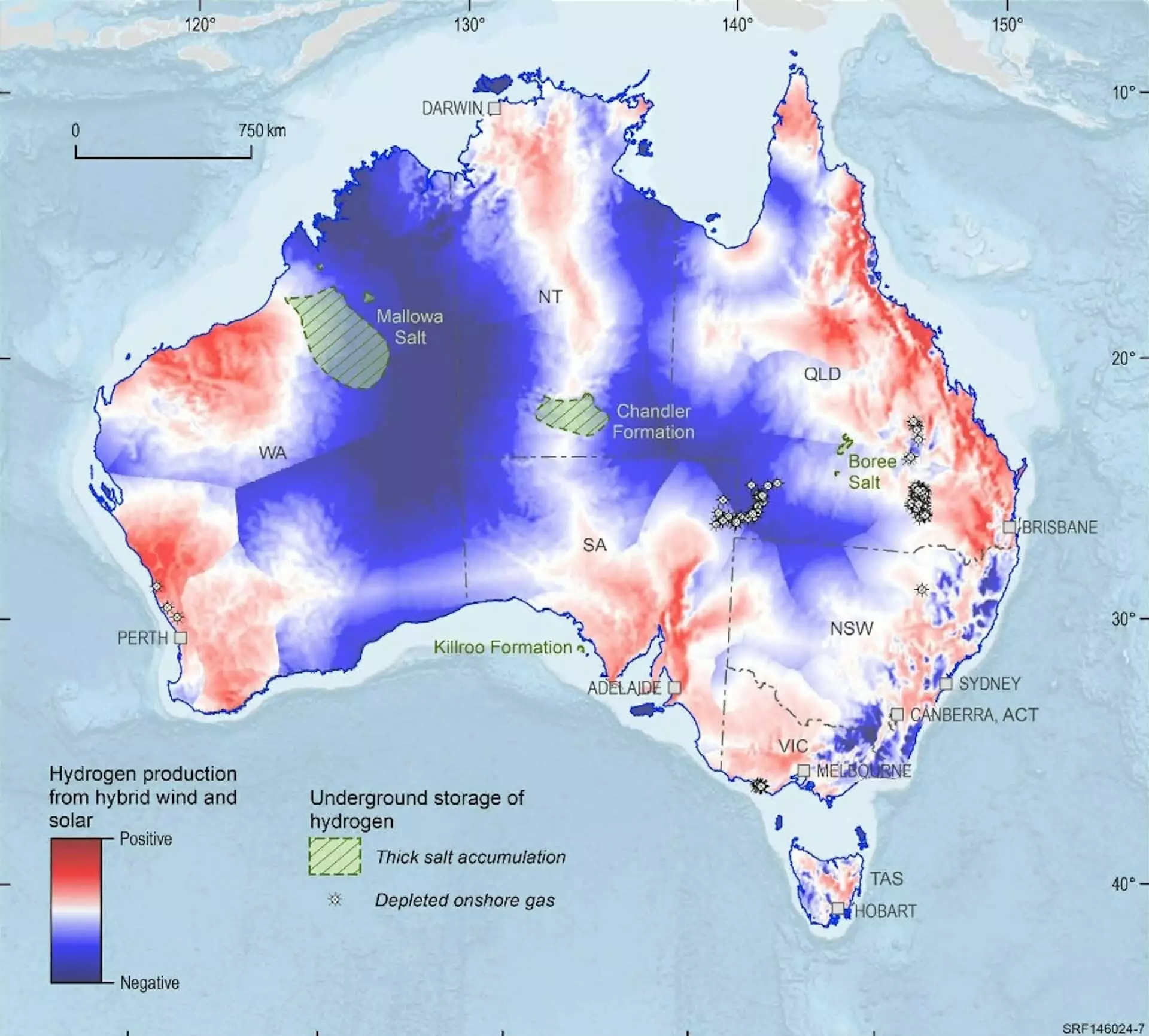

Despite the promise, significant hurdles loom on the horizon. Currently, the production cost of green hydrogen is notably higher than conventional fossil fuels. The targets laid down in the new strategy, which suggest a goal of 500,000 metric tons of green hydrogen production by 2030—and a stretched target of 1.5 million metric tons—might seem ambitious, yet achieving these milestones will require overcoming systemic obstacles. Australia must address not only the financial barriers but also the technological challenges relating to hydrogen storage, transportation, and infrastructure development.

The previous focus on a $2 per kilogram target has rightly been reassessed, as it failed to account for the multifaceted costs associated with hydrogen. The present strategy must tread carefully in finding a balance between promoting production capabilities and ensuring the economics are viable for potential investors.

The refreshed strategy identifies three pivotal industries—iron, alumina, and ammonia—where hydrogen could contribute to economic growth and emissions reductions. Additionally, it suggests hydrogen’s potential application in aviation, shipping, electricity storage, and freight transport. This targeted approach reflects a pragmatic shift in recognizing hydrogen’s limitations, particularly when compared to electric solutions for passenger vehicles or renewable electrification for domestic energy needs.

However, a vital question arises: How will the government prioritize support and funding for these sectors? Will hydrogen projects that underdeliver face the specter of government withdrawal of financial support? Clarifying these uncertainties will be critical in strengthening investor confidence and guiding effective capital allocation.

The international dynamics surrounding hydrogen exports have shifted considerably since 2019, with Europe emerging as a formidable market for Australia’s potential hydrogen exports, particularly under evolving green agendas. Collaboration with Germany through a proposed A$660 million financial agreement illustrates Australia’s commitment to not only serve as a supplier but also partake in the international dialogue around green energy initiatives.

Yet, one cannot ignore the inherent challenges of transporting hydrogen safely and economically. Strategies that prioritise domestic industrial applications may offer more immediate benefits than expansive export ambitions, which could be hampered by infrastructure and technological deficits.

Community acceptance remains an essential pillar of the hydrogen strategy, underscoring the necessity for transparency and dialogue regarding safety concerns and the potential social ramifications of implementing hydrogen technologies. Consultation with First Nations and an emphasis on sustainable practices reflects an inclusive approach that aims to garner public trust. Previous strategies have underlined the potential hazards associated with hydrogen, and while there’s a clear emphasis on safety, how effectively will community concerns be addressed as developments progress?

Moreover, integration with broader initiatives, such as the $2 billion Hydrogen Headstart grants and the proposed tax credits for hydrogen producers, raises questions about the effectiveness and timing of these incentives. Effective calibration of these supportive measures is essential; otherwise, funds risk being allocated to projects lacking in future viability.

The National Hydrogen Strategy sets a clear course for Australia’s transition towards a green economy, marking an ambitious endeavor that hinges on effective governance, investment, and community involvement. The strategy will undergo another review in 2029, lending it a flexible yet accountable framework for tracking progress and success. Indicators to watch for will include successful financing of large-scale hydrogen projects, agreements with potential buyers, and the development of necessary infrastructure.

Ultimately, while Australia stands at the precipice of a hydrogen revolution, continuing to adapt and respond to scientific, economic, and community feedback will be crucial. Without timely interventions and realistic assessments of both marketed hydrogen solutions and technological advancements, Australia risks falling behind in its pursuit of becoming a credible player in the global green hydrogen arena.