The unicorn phenomenon, defined by startups attaining valuations of $1 billion or more, continues to attract significant attention in the investment landscape, especially as projections for potential public offerings are emerging for the upcoming year. This analysis delves into the findings from the PitchBook/NVCA Venture Monitor and discusses the implications for both investors and startups eyeing an IPO in 2025.

As it stands, the landscape of U.S. unicorns presents a mixed bag of opportunities and challenges. According to insights from the PitchBook/NVCA Venture Monitor for Q4 2024, a considerable number of these high-value startups are preparing for the public markets, with forecasts suggesting a noteworthy influx of IPOs in 2025. The tool developed by PitchBook, known as the VC exit predictor, utilizes machine learning at its core to analyze a startup’s trajectory by tapping into extensive databases that encompass companies, their funding rounds, and associated investors. Consequently, this robust framework generates a likelihood percentage pertaining to potential exits—be it through acquisition, public offering, or failure.

Despite the allure of the unicorn label, there remains an underlying tension within the venture capital (VC) ecosystem. Nizar Tarhuni, Executive Vice President at PitchBook, highlights that while the last year saw an increase in financing and investments—especially with the spotlight on early-stage AI ventures—this growth belies deeper, systemic issues in the venture sector.

One significant obstacle challenging the VC landscape is the persistent mismatch in valuations between buyers and sellers. The aftereffects of inflated valuations from previous fundraising rounds continue to reverberate, creating a cautious market atmosphere. Tarhuni points to regulatory impediments as a further deterrent to potential transactions, leading to a scarcity of apparent exits. The current state mandates a recalibration of expectations for startups and investors alike, as the market seeks viable pathways to bridge this valuation gap.

While there is cautious optimism for 2025, challenges are anticipated to remain. Fundraising may continue to reflect a lukewarm climate, as venture capital will need to contend with burgeoning competition for investment dollars from alternative asset classes. There are indications that the largest venture platforms and more established fund managers could benefit the most from such shifts.

Contrasting with the underlying challenges, recent statements by Bobby Franklin, CEO of the National Venture Capital Association (NVCA), reveal a budding optimism within the VC and entrepreneurship community. Franklin notes that the investment surge witnessed during the last quarter indicates momentum, marking the highest levels of investment since mid-2022. Regulatory reforms, particularly changes in leadership at the Federal Trade Commission (FTC) and the Department of Justice (DOJ), are identified as possible catalysts to alleviating liquidity hurdles faced by portfolio companies.

Moreover, Franklin emphasizes the importance of the anticipated tax bill in Congress, which may incentivize innovation through reinstatement of key credits like the R&D tax credit. Such legislative changes, coupled with proactive engagement by venture capitalists with policymakers, position the venture industry to advocate for its significant role in fostering economic growth.

In exploring which unicorns have the most favorable outlook for public offerings, PitchBook identifies a host of companies with impressive probabilities. Companies such as Anduril, co-founded by Palmer Luckey, and the Web3 gaming enterprise Mythical Games both boast a remarkable 97% likelihood of going public in 2025. Others, including Impossible Foods and SpaceX, also receive high probability scores, underscoring the diversity of industries primed for capital market entry.

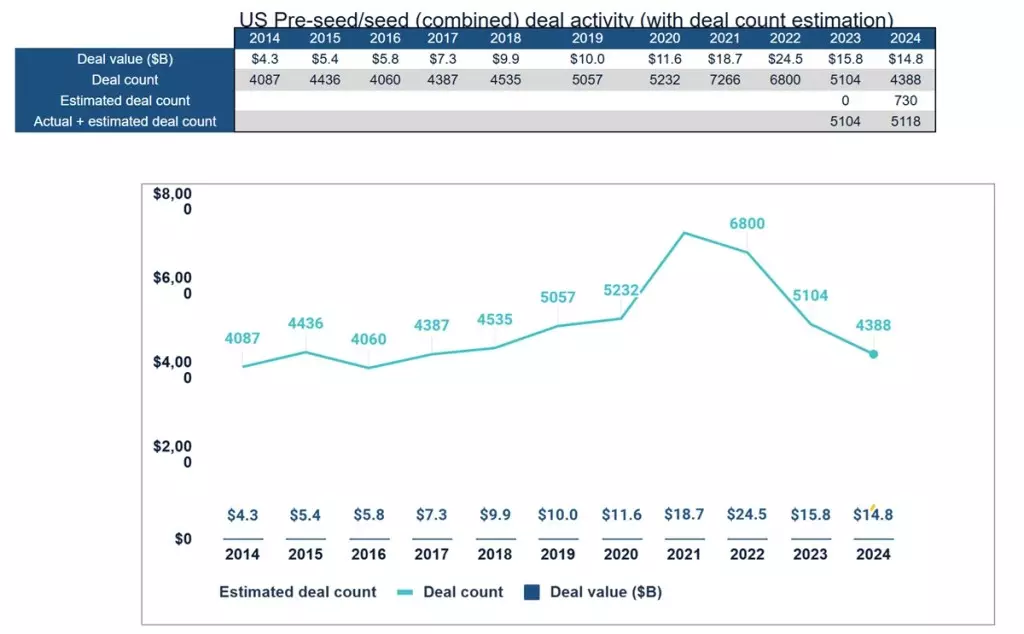

Despite some downturn in deal frequency for smaller funding rounds (notably those between $1 million to $5 million), the presence of established players still shines through. In 2024, while fewer startups operated within that funding tier compared to earlier peak years, the resilient nature and adaptability of unicorns continue to signal a dynamic evolution within the venture ecosystem.

While the road to IPOs for numerous U.S. unicorns in 2025 may be paved with regulatory challenges and valuation concerns, there lies a cautious optimism stemming from emerging legislative support and a commitment to recalibrating strategies within the venture capital landscape. Investors and startups alike are at a crucial juncture—one that necessitates a balanced approach to capitalize on opportunities while navigating the complexities inherent in a rapidly changing market. The narrative unfolding in the coming year will undoubtedly shape the next generation of high-value startups poised for public success.