In an unexpected pivot, President Donald Trump has chosen to retreat from imposing tariffs on electronics, a move that reverberates beyond immediate economic implications. This decision comes as a response to concerns about ongoing turbulence in the stock market and increased lobbying pressure from the technology sector. Recent adjustments by the U.S. Customs and Border Protection revealed a pivotal change: several consumer electronics, primarily sourced from China, have been exempted from hefty tariffs that previously reached as high as 145%. This shift signals a recognition of the intertwined fate of the U.S. economy and its technology sector, a relationship that cannot be remedied by punitive tariffs alone.

One significant consequence of the newly exempted tariffs would be the salvation of affordability for everyday consumer electronics. Items such as smartphones, laptops, and particularly semiconductors, which are the cornerstone of modern technology, would no longer bear an exorbitant tax burden. This reversal suggests that the administration is beginning to acknowledge what many analysts have argued for years: tariffs on such crucial components could severely hinder the functionality and growth of the U.S. economy. If the country seeks to maintain its leadership position in global technology, halting tariffs on these goods is not just pragmatic; it is essential.

The Implications of Uncertainty in Trade Policies

While this maneuver provides a temporary respite, there remains lingering uncertainty surrounding Trump’s trade policies. Investors and market analysts alike must grapple with the unpredictable nature of the current administration’s approach to international trade. With the stock market having slid 15% since Trump took office, there are legitimate concerns regarding whether this recent exemption will have a positive ripple effect on investor confidence. The very nature of Trump’s actions—often abrupt and without warning—leaves stakeholders unsure of what to expect next, which can stifle investment and innovation within the technology sector.

This creates a paradoxical environment in which some companies—like Apple—may have their short-term interests momentarily appeased, yet the overarching unpredictability of trade relationships can lead to long-term instability. The concern is not merely financial; it extends to the very foundations of technological innovation and job creation. Higher costs of consumer electronics as a result of tariffs could inadvertently inhibit both company growth and consumer spending power.

Market Dynamics and the Rise of Global Competitors

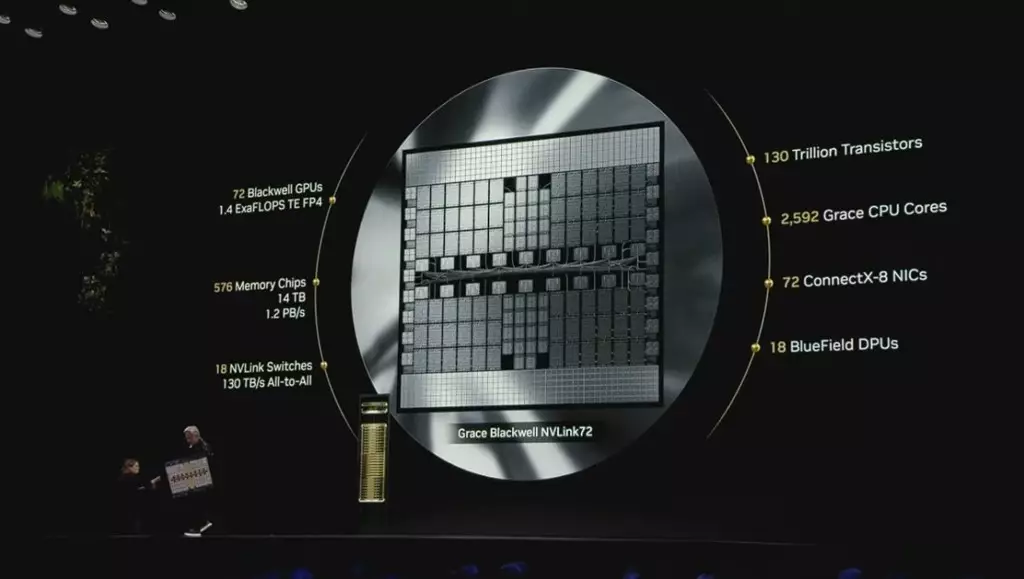

The discussion surrounding tariffs inevitably leads to the urgent need for a broader understanding of market dynamics, especially in the context of semiconductor production. The U.S. has seen a worrying trend: a decline in market share in chip manufacturing over the past several decades. This phenomenon has been significantly influenced by formidable competitors such as Taiwan’s TSMC, which have developed advanced manufacturing capabilities.

Despite efforts like the bipartisan U.S. Chips and Science Act, which allocates funding for the development of domestic semiconductor manufacturing, analysts caution that regaining market share in this arena will require more than just financial investment. It necessitates a complete overhaul of how the industry operates, an endeavor that could take decades to actualize. As experts like Duncan Stewart from Deloitte suggest, the anticipated growth in U.S. market share in semiconductor manufacturing will be minor and painstaking.

The core challenge lies in not merely manufacturing within U.S. borders, but fostering an entire ecosystem that supports innovation and design, akin to what Nvidia achieved through collaboration with TSMC. It prompts us to reassess the conventional wisdom that manufacturing alone equates to economic advantage. The landscape is now filled with the complexities of global supply chains, where design innovation, research, and development play pivotal roles in maintaining a competitive edge.

Reevaluating the Workforce and Educational Imperatives

Another critical aspect of this discussion centers on the workforce needed to support a thriving technology sector. With the reality that countries like China are producing a higher number of engineers than the U.S., there is an urgent need for the American education system to adapt and enhance its focus on STEM disciplines. The disparity in educational outcomes highlights a broader issue: that even with favorable policies, the U.S. might struggle to compete globally without a robust educational framework capable of producing the next generation of innovators.

The Trump administration’s approach, framed as an effort to eliminate reliance on foreign production, must also incorporate measures to uplift domestic job creation and workforce education. High-value job creation in technology demands not only a skilled workforce but one that is adaptive to rapid technological changes. Thus, the synergy between policy, education, and manufacturing becomes a focal point in achieving long-term economic competitiveness.

The narrative surrounding tariffs and U.S.-China trade relations is multifaceted and complex. As this saga continues to unfold, a major question remains: can the U.S. strike the right balance between putting protective measures in place while fostering an environment conducive to innovation, competition, and talent development? It is crucial to pivot from a solely punitive approach towards more strategic initiatives that enhance U.S. global standing in technology.