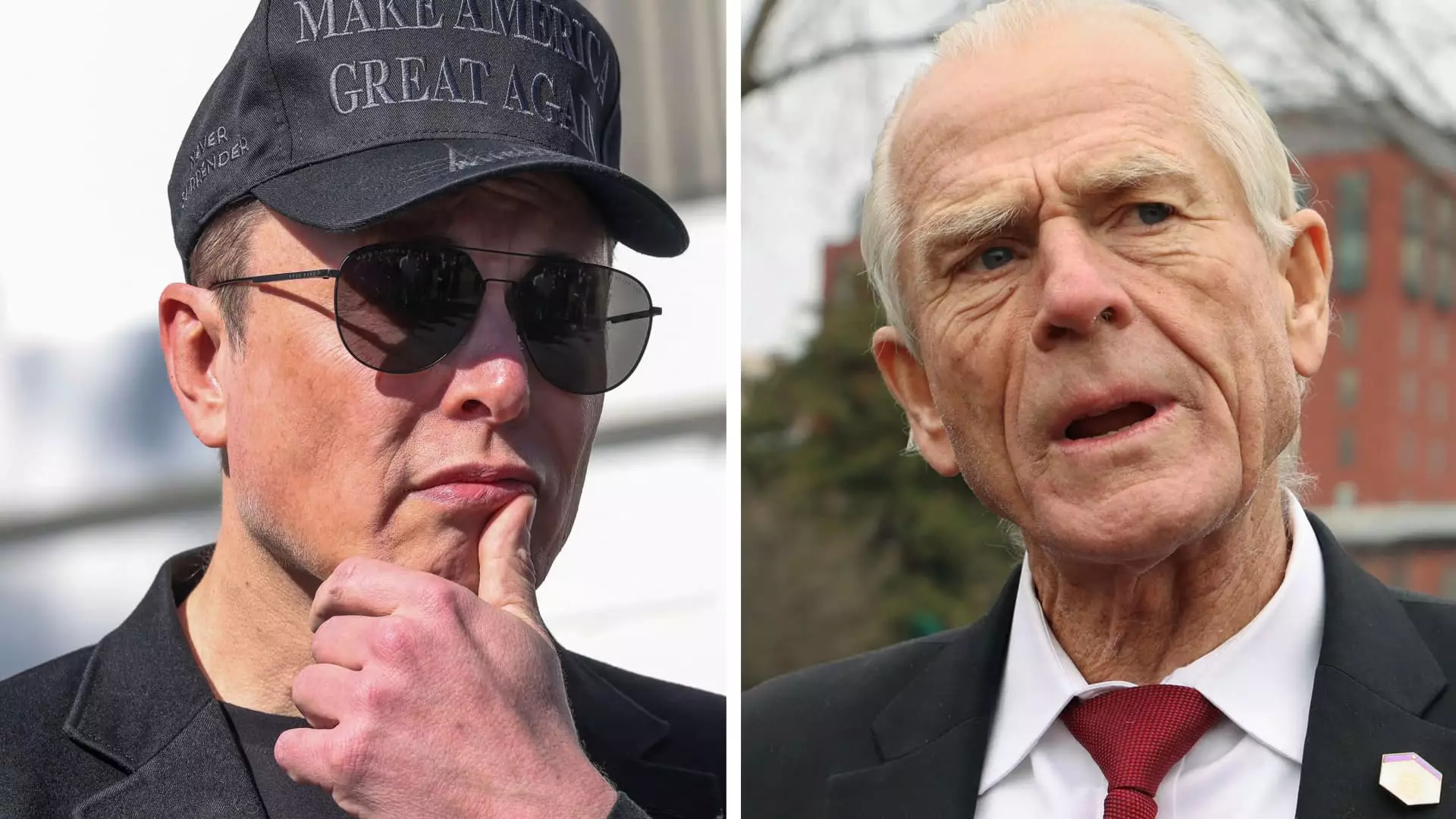

In recent days, the public sparring between Elon Musk, CEO of Tesla and SpaceX, and Peter Navarro, a key advisor to former President Donald Trump, has captivated the attention of both investors and the media. With Tesla’s stock experiencing a troubling decline—losses of over 22% over four trading sessions and more than 45% year-to-date—Musk’s frustration has reached a boiling point, leading him to go on the offensive against Navarro. What commenced as a critique of Navarro’s economic credentials has devolved into a caustic battle of words, with Musk labeling Navarro as “dangerously dumb” and “truly a moron.” Such animosity not only illuminates Musk’s raw temperament but also reflects the broader turmoil currently engulfing the automotive industry and market-driven economies at large.

Financial Fallout

The stakes are extraordinarily high for Musk, who, despite being the world’s richest individual, is witnessing catastrophic losses on paper due to Tesla’s market slump. With over $585 billion wiped off Tesla’s market value in less than a year, the pressure is palpable. Financial analysts had initially anticipated that Tesla’s domestic assembly operations would cushion the impact of new tariffs imposed on imported vehicles, but the reality is more complicated. Rising production costs due to tariffs on essential materials sourced internationally—especially steel and aluminum from Canada and Mexico—pose serious threats to Tesla’s profitability. Musk’s sharp rhetoric, therefore, can be seen as both a reaction to personal financial distress and an effort to unify his base amid escalating pressures from governmental policies impacting trade.

Political Misalignment

Musk’s tirade against Navarro also highlights a friction within the Trump administration regarding trade policy. While Navarro’s hardline stance on tariffs is designed to protect American manufacturing, Musk advocates for reduced barriers to trade, showcasing his preference for a “zero-tariff situation” that fosters economic collaboration between Europe and North America. The discrepancy between Musk’s opinions and those of the political elite within Trump’s inner circle illustrates a potential rift—a dynamic highly unusual for an influential business figure like Musk. This divergence raises questions about the compatibility between tech entrepreneurs and traditional economic advisors, particularly in an environment where rapid technological change often disrupts conventional business models and processes.

Business Realities

Underlying this discord is a stark reality: Tesla has not been immune to turbulence, even prior to the tariff announcements. Recent reports indicated a 13% decline in year-over-year deliveries for the first quarter, missing analysts’ projections significantly. These figures, accompanied by a desperate need for cost-cutting measures across the board, are undermining the confidence of investors and stakeholders alike. Musk’s confrontational approach toward Navarro may therefore serve as a coping mechanism, redirecting attention away from Tesla’s internal struggles and placing blame externally. However, this strategy may have a limited lifespan as investors begin to question the efficacy of such distractions against the backdrop of tangible business challenges.

The Ambiguous Future

While Musk’s public persona often projects an aura of effortless control, the ongoing situation reveals an unsettling volatility within both his companies and personal investments. Political activists have taken notice, with Musk becoming a target for protests and boycotts ignited by his controversial statements and political involvements. As Tesla grapples with increasingly complex dilemmas in a challenging economic landscape, Musk stands at a crossroads. He can either double down on his combative rhetoric with Navarro as a distraction or pivot toward a more grounded, solutions-oriented approach that addresses the core issues facing his business.

The term “boys will be boys,” invoked by White House press secretary Karoline Leavitt to characterize Musk and Navarro’s feud, may apply to the robust personalities involved. Still, the reality of diversified economic interests and shareholder expectations begs for deeper contemplation. How long can Musk’s bravado sustain him in the face of dwindling market performance and widespread criticism? This unfolding episode serves as a clear reminder of the unpredictable nature of both business and politics, where the stakes—and the headlines—are always dangerously high.