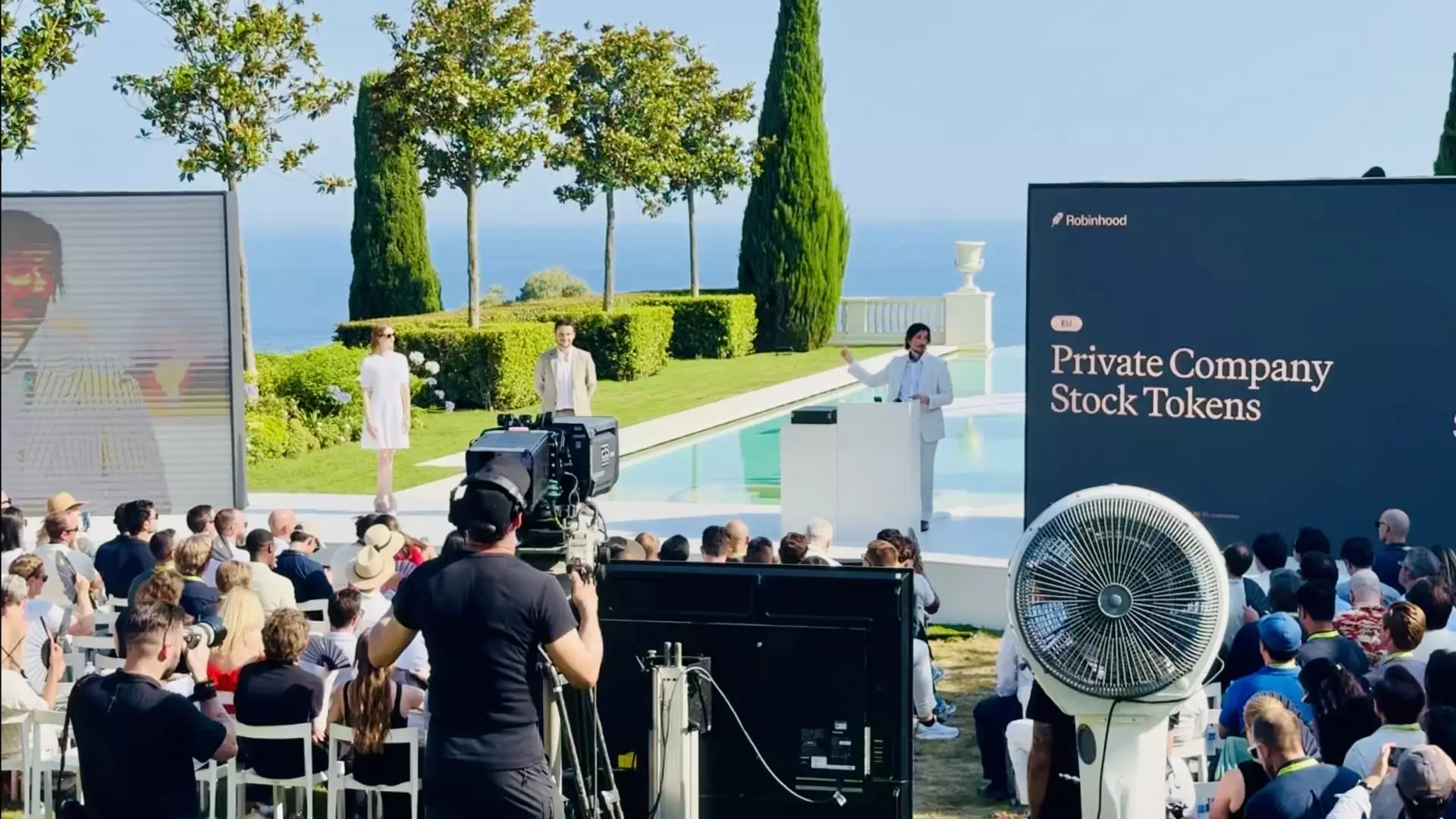

Robinhood’s recent announcement in Cannes marks a significant turning point in the intersection of blockchain technology and private equity trading. The rollout of tokenized shares of private giants OpenAI and SpaceX to European users is not just a product launch—it’s a deliberate challenge to the traditional exclusivity surrounding private company investments. For decades, access to these high-growth, non-public companies has been confined to a narrow circle of insiders and ultra-wealthy investors. Robinhood’s strategy to use blockchain to democratize this market could redefine how private equity is perceived and accessed globally.

The company’s decision to begin this initiative in Europe reveals much about the strategic considerations imposed by regulatory environments. The European Union’s comparatively flexible framework around digital assets and financial participation paved the way for this launch. Unlike the U.S., where accredited investor regulations and heightened scrutiny from regulators—especially the SEC—continue to throttle innovation, the EU’s landscape offers a more fertile ground. Robinhood has leveraged this to offer over 200 tokenized stocks and ETFs on a commission-free, 24/5 trading schedule, signaling its commitment to greater inclusivity.

Tokenization as a Catalyst for Equality in Investing

The concept of tokenization—transforming equity shares into blockchain tokens—acts as a powerful equalizer. According to Johann Kerbrat, Robinhood’s crypto lead, the mission goes beyond business expansion; it’s about addressing historical inequalities in financial opportunity. This vision resonates in the gesture of gifting €5 worth of OpenAI and SpaceX tokens to new European users, a symbolic and practical push to onboard a broader swath of retail investors.

It’s clear that Robinhood isn’t just offering new products; it’s proposing a new philosophy for private markets. By allowing fractional ownership with lower barriers to entry and round-the-clock availability, Robinhood could dismantle traditional gatekeeping mechanisms. This move transforms private equity from an exclusive playground into a more open, liquid, and accessible asset class. However, this bold vision also rests on a massive infrastructural overhaul involving the integration of a new Layer 2 blockchain based on Arbitrum, a tech stack chosen to ensure scalability and reduce transaction costs.

The U.S. Market: Regulatory Challenges and Future Prospects

Despite the excitement in Europe, Robinhood’s American users face an unavoidable wall: regulatory constraints. The U.S. securities framework, burdened by accredited investor rules, restricts who can legally invest in private offerings, and the SEC’s historically cautious stance on crypto products creates additional hurdles. CEO Vlad Tenev’s vocal advocacy for reform reflects an industry-wide frustration—blockchain’s promise to expand access to private equity cannot be fully realized until regulatory modernization catches up.

Yet, even with tokenized private shares on hold, Robinhood is making strategic moves in crypto staking stateside by launching yield-bearing features for Ethereum and Solana. These offerings, previously blocked by regulators, demonstrate a measured but determined approach to introducing sophisticated crypto products within legal boundaries. It signals that Robinhood is not waiting passively; rather, it is actively evolving its U.S. product line while lobbying for more accommodating policies.

Implications for Retail Investors and Market Dynamics

Robinhood’s initiative could catalyze a profound shift in retail investment behavior. Traditionally, private companies—due to their illiquidity and exclusivity—were considered out of reach for most retail traders. Tokenized equity can unlock new avenues for diversification and potential high returns, but it also introduces fresh challenges. Market participants must grapple with issues of valuation transparency, regulatory oversight, and risks inherent in private company investments that might not have the same reporting rigor as public entities.

Furthermore, the seamless, commission-free model raises questions about whether easy access might encourage speculative behaviors or insufficient diligence among a broader investor base. Robinhood’s gamble is that education, combined with infrastructure innovation, will enable users to engage thoughtfully with these assets. Should this approach succeed, it might pressure incumbents—traditional brokerages and private equity funds—to rethink their business models and the lifecycle of private investments.

In any case, this bold step signals that Robinhood is not content to merely be a disruptive force in public markets but aims to rewrite the rules of private investing altogether. The coming months and years will reveal whether the marriage of tokenization and regulatory interest can deliver on this transformative promise.